By: Dennis M. Germain, Macomb, Michigan Family Law Attorney & Counselor at Law

INTRODUCTION

This article is Part One of the series, “Dividing Property & Debt in a Michigan Divorce.” When it comes to dividing property and debt in a divorce case, clients often ask me questions such as:

“Who gets to keep the house in the divorce?”

“Do I have to take on my husband’s debt in the divorce?”

“Will my wife get to take my retirement assets in the divorce?”

In most instances, the answer to all three of these questions is, “It depends.” A family court should not typically be dividing items of property and debt in a piecemeal fashion. Division of property and debt requires looking at the entire estate of both parties. There is a step by step analysis that should occur before arriving at the final conclusions as to “who gets what stuff.” This analysis should typically entail the following steps: (1) Inventory (itemizing and valuing) of all of the parties’ property and debt; (2) characterizing what property and debt are part of the marital estate and what is part of each party’s separate estates; (3) equitably dividing the marital estate; and (4) identifying whether invasion of either party’s separate estate is appropriate. FN1. Going through these steps is important, particularly in a high asset divorce case. This article focuses on the inventory stage of the analysis.

STATUTORY BACKGROUND

Before jumping into the details of the inventory step, it is important to understand statutory background regarding property and debt division relative to a Michigan divorce. Some of the basic guidelines under Michigan law are listed as follows:

MCL 552.19 states:

Upon the annulment of a marriage, a divorce from the bonds of matrimony or a judgment of separate maintenance, the court may make a further judgment for restoring to either party the whole, or such parts as it shall deem just and reasonable, of the real and personal estate that shall have come to either party by reason of the marriage, or for awarding to either party the value thereof, to be paid by either party in money.

MCL 552.401 states:

The circuit court of this state may include in any decree of divorce or of separate maintenance entered in the circuit court appropriate provisions awarding to a party all or a portion of the property, either real or personal, owned by his or her spouse, as appears to the court to be equitable under all the circumstances of the case, if it appears from the evidence in the case that the party contributed to the acquisition, improvement, or accumulation of the property….

MCL 552.23(1) states:

Upon entry of a judgment of divorce or separate maintenance, if the estate and effects awarded to either party are insufficient for the suitable support and maintenance of either party and any children of the marriage who are committed to the care and custody of either party, the court may also award to either party the part of the real and personal estate of either party and spousal support out of the real and personal estate, to be paid to either party in gross or otherwise as the court considers just and reasonable, after considering the ability of either party to pay and the character and situation of the parties, and all the other circumstances of the case.

The combination of these three statutory excerpts (and the vast body of case law interpreting these laws) tends to indicate that any and all property and debt of the parties (including such items accumulated before and after the parties became married) can be analyzed when dividing property and debt in a divorce. With that understanding, it makes sense to start a divorce case by creating an inventory of each item of property and debt that both divorcing spouses hold.

ITEMIZING THE PROPERTY & DEBT

Michigan law is very broad in terms what constitutes “property” in a divorce case. When itemizing the parties’ assets, it is the best bet to start by including almost any “thing” of value, whether the thing represents a current, future, or potential interest in property, whether it is tangible or intangible, or whether it is vested or non-vested. For example, this itemization could entail a marital home, other real estate, vehicles, business interests, retirement accounts and plans, bank accounts, credit card reward points, investment funds, annuities, potential legal causes of actions, securities, patents, jewelry, tools, equipment, pets, and anything else that could be reduced to a monetary value.

Likewise, all major outstanding debts should be itemized. Debts should be assigned a negative value. Itemization of outstanding debts could entail personal lines of credit, loans, encumbrances against property (e.g. mortgages, financing on vehicles, etc.), business debts, medical bills, gambling debts, back taxes owed, and anything else for which a monetary obligation of either or both parties is outstanding.

VALUING THE PROPERTY & DEBT

Next, it is important to assign a value to each item of property and debt. There are many ways in which the value of a particular item of property or debt can be established. Account statements and balance sheets will help identify the value of certain items (e.g., statements for bank accounts, investment accounts, retirement plans, mortgages, lines of credit, etc.). When the value of an item cannot be established by account statements, an easy method of valuation is for the parties to agree to the value of the item. Unfortunately the parties do not always agree on the value of certain items.

When parties cannot agree to the value of a given item, the parties may be required to hire expert witnesses to assist them in convincing the court of the appropriate value of the item. Such expert witnesses could include professional appraisers, actuaries, accountants, or other professionals. A court is afforded great discretion when it comes to reviewing the evidence presented at trial and assigning value to an item. FN2. Thus, it is best for a party to prepare a comprehensive and convincing presentation with regard to the proposed value of a given item.

ADJUSTMENTS TO VALUES

Additionally, it may be most fair to have the value of certain assets adjusted to their post-tax or post-transaction values. An easy example to consider is that $50,000.00 sitting in a savings account at a bank does not represent the same value as $50,000.00 sitting in a tax-deferred retirement account. In most cases, the funds in the savings account have already been taxed. But the funds in the tax-deferred retirement account are subject to a reduction in value because they will inevitably be taxed at the effective income tax rate at the time of distribution.

In general, one could expect a court (upon a party’s proper presentation of evidence) to take into account inevitable, reasonably foreseeable, or maybe even reasonably probable, tax or transaction consequences on certain assets. FN3. However, one should not expect a court to be willing to adjust the values of assets where taxation or transactional costs are highly speculative or may or may not occur. FN4.

ORGANIZING THE INFORMATION

In a divorce case, a prudent family law attorney will usually present his or her client with detailed worksheets and requests for documents to aid in completing an intake of information regarding the parties’ property and debt. Often a party’s attorney will also have to send out discovery requests to obtain information in the possession or reasonable access of the opposing spouse.

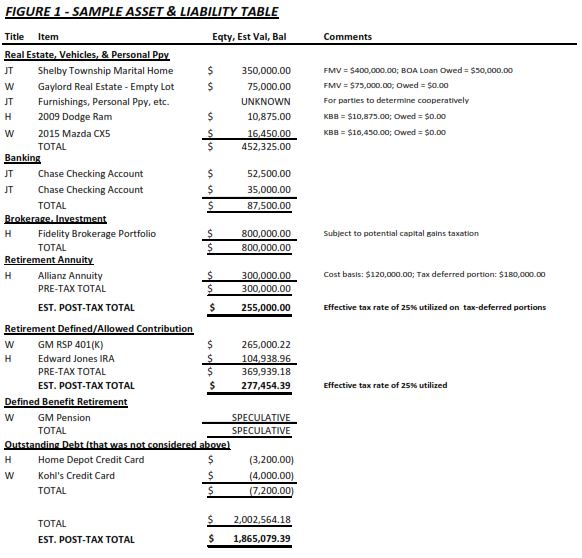

Once the intake of information is complete, a prudent divorce attorney should carefully organize the information in a manner that captures a picture of the entire estate of both parties. An asset and liability table is a useful tool for doing so. Figure 1 below is an example of an asset and liability table at the end of the inventory stage in a divorce case.

As the values of certain assets and debt constantly change, the values might have to be updated throughout the divorce case. In some instances the parties or the court might assign a valuation date for certain assets and debt, so the parties are not constantly dealing with moving targets.

The next article will focus on step 2, “characterization,” and will discuss characterizing what property and debt is part of the marital estate and what is part of each party’s separate estate.

END.

FN1 – It should also be noted that, depending on the facts of a given case, each step could contain many subcategories of steps that might not be addressed in this series. It should also be noted that, depending on how a case tends to unravel, the steps might not always occur in the exact order as described in this article. Each case is different.

FN2 – Stoudemire v Stoudemire, 248 Mich App 325, 338-340; 639 NW2d 274 (2001).

FN3 – E.g., see Everett v Everett, 195 Mich App 50; 489 NW2d 111 (1992). Also see Nalevayko v Nalevayko, 198 Mich App 163, 497 NW2d 533 (1993). Also see Stanko v Stanko, unpublished opinion per curiam, Michigan Court of Appeals, issued Jul 20, 2001 (Docket No 220167).

FN4 – E.g., see Hanaway v Hanaway, 208 Mich App 278; 527 NW2d 792 (1995). Also see Allen v Allen, unpublished opinion per curiam, Michigan Court of Appeals, issued Nov 19, 1994 (Docket No 162979).

******************************************************************************

Please note that this article is intended to be academic in nature. Its purpose is to serve as a memorialization of research as well as invoke community discussion. This article shall not constitute legal advice. It does not create an attorney-client relationship. Legal advice should be given on a case-by-case basis, as its accuracy is relative to the timing and particular facts of the given matter. It is important to always consult an attorney regarding legal matters.

******************************************************************************

I am Dennis M. Germain, a Michigan family law attorney who promotes fair resolutions to domestic relations matters. I primarily practice in Macomb County, Wayne County, and Oakland County, Michigan. My office is in Shelby Township, Michigan. My office and contact information is listed as follows:

Best Interest Law

48639 Hayes Road, Suite A

Shelby Township, MI 48315

Ph: (586) 219-6454

Fax: (586) 439-0404

Email: dennis.germain@bestinterestlaw.com

Ask a Family Law Attorney

Ask a Family Law Attorney

Recent Featured Articles

Recent Featured Articles

Client Testimonials

Client Testimonials